Rabbu's Milestone: Pioneering the Future of Airbnb Investments

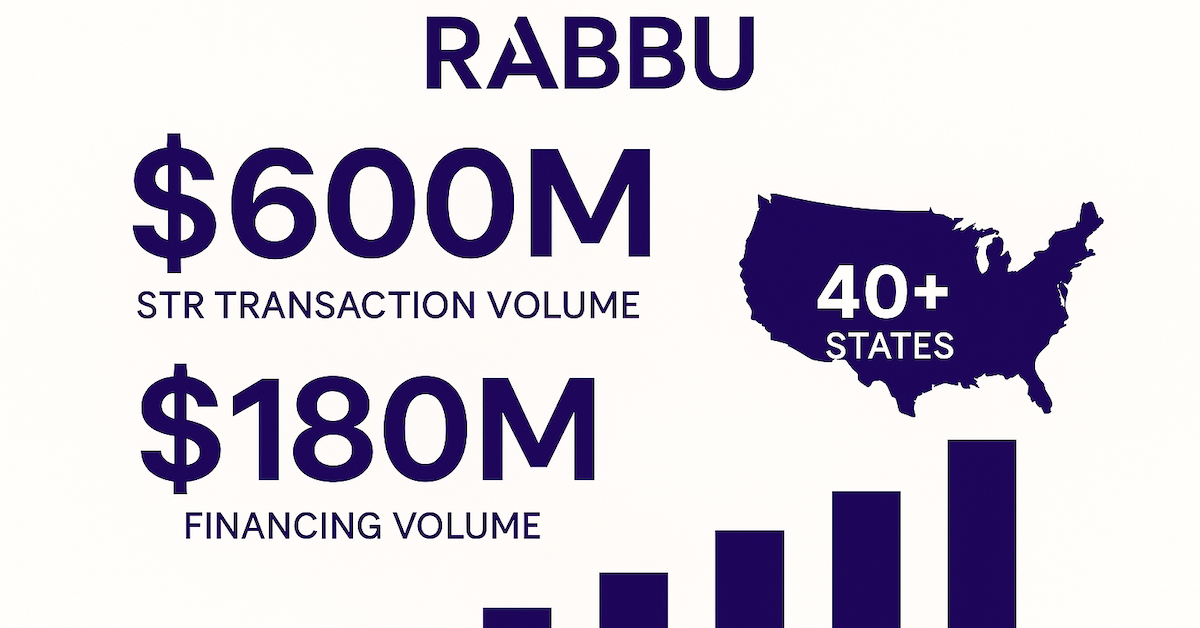

Rabbu, a trailblazer in the short-term rental market, has achieved over $600 million in real estate transactions and $180 million in loan originations in 2025. This milestone underscores the evolution of Airbnb investments from side hustles to a professional asset class, fueled by sophisticated analytics and specialized financing.

Found this article helpful?

Share it with your network and spread the knowledge!

TLDRQuick Summary for Different Perspectives

- Rabbu's achievement of over $600 million in transactions positions investors to capitalize on the growing Airbnb investment sector.

- Rabbu provides turnkey Airbnb investment opportunities, real-time income projections, and specialized financing, reflecting its role in the Airbnb market's maturation.

- The evolution of short-term rental properties into a recognized investment class helps diversify income sources, promoting economic resilience.

- Rabbu's platform now covers more than 40 states, offering a wide array of Airbnb properties for investment.

The Rise of a New Investment Era

Imagine a world where investing in Airbnb properties is as streamlined and data-driven as trading stocks. Well, folks, we're not just imagining it anymore; it's happening right now. Rabbu, a heavyweight in the short-term rental marketplace, has just announced a whopper of a milestone: facilitating over $600 million in real estate deals and a cool $180 million in loan originations in 2025 alone. This isn't just a big win for Rabbu; it's a giant leap for the Airbnb investment market.

What we're seeing here is a seismic shift from Airbnb hosting being a quirky side gig to a legit, recognized investment class. This transition is powered by investors who crave more than just a piece of property; they want turnkey solutions, predictable cash flows, and, most importantly, data-backed decisions. Rabbu's CEO, Emir Dukic, hit the nail on the head when he said, "We're witnessing the professionalization of an asset class." And honestly, I couldn't agree more.

Why Investors Are Flocking to Rabbu

So, what's drawing investors to platforms like Rabbu? In a nutshell: access, analytics, and assurance. Rabbu offers exclusive Airbnb inventory, real-time income projections, occupancy modeling, and verified revenue histories. These are the kind of juicy details that you just won't find on traditional real estate platforms like Zillow or Realtor.com.

This year's growth spike reflects a broader trend where investors are hungry for properties that are not just buildings, but businesses with established booking histories and operational infrastructures. They're looking for investments that come with predictable cash flow analyses based on solid, local market data and specialized financing options tailored to the unique economics of short-term rentals (STRs). And with economic uncertainties making headlines, it's no wonder that these income-generating assets, with their verifiable performance metrics and dynamic pricing flexibility, are becoming increasingly attractive.

Looking Ahead: The Future of STR Investing

With Rabbu expanding its STR-specialized agent network to more than 40 states and rolling out new underwriting tools that marry property-level performance data with market analytics, the future looks bright for short-term rental investing. As the market continues to evolve, investors are moving beyond gut instincts. They're demanding lender-ready reports, historical comps, and a level of confidence in their underwriting that was previously unheard of in the STR sphere.

What Rabbu's achievements signify is not just a win for the company but a monumental shift in how short-term rental properties are perceived and invested in. It's about the transformation of a fragmented market of individual Airbnb hosts into a sophisticated, data-driven investment category. This is a game-changer, folks. It shows that the Airbnb investment market isn't just growing; it's maturing, and it's exciting to think about where it's headed next.

About Mark Willaman

Mark Willaman is a media-tech entrepreneur and marketing strategist with decades of experience in the newswire and communications industry. After starting his career at Johnson & Johnson, he founded HRmarketer, Fisher Vista, SocialEars, and Advos.io, and later co-founded Newsworthy, NewsRamp, Newswriter, and Burstable.news. Mark has pioneered new ways to transform and amplify press releases—shifting the focus from vanity metrics to measurable ROI, engagement, and discoverability. A strong supporter of independent media and reporting, he builds platforms that help organizations share their stories freely, without corporate and media gatekeepers.